According to Sigmagazine on September 17, the Italian House of Representatives Finance Committee will launch an investigation into the retail tax system and franchise system for tobacco products and new tobacco products on the afternoon of September 18 local time.

The Italian Tobacco Merchants Union (Unione Italiana Tabaccai, Uit), the Tobacco Merchants Association (Assotabaccai) and the Italian Tobacco Merchants Federation (Federazione Italiana Tabaccai, Fit) will appear in this parliament.

It is expected that on September 19, the committee will decide on the next hearing objects, and three associations in the Italian vape industry will be included, including the Street Retailers Association (Uniecig), the E-Commerce Association (Aive) and the Association of Manufacturers and Retailers (Anafe). The Bureau can also add other institutions and stakeholders as needed. This is the first time that the Italian political circles have officially invited the industry to a dialogue and recognized its status as a formal dialogue partner, which has never happened between the two sides.

It is reported that traditional tobacco products in Italy, especially cigarettes, are gradually losing market share, while new tobacco products have soared from 4% to 18% in just four years (2019-2023). According to the European Commission, there is no unified regulation of new tobacco products across Europe, which leads to tax differences and even encourages cross-border purchases and smuggling.

In view of changes in consumer behavior and sales trends, Italian legislators have redesigned the tax system for tobacco products. During the 17th Parliament, in addition to reforming the tax structure and standards for processed tobacco, excise taxes were imposed on non-combustion inhalation tobacco and alternative vape oils. The excise tax rates for these products have been adjusted several times in the past few years.

The 2020 Finance Bill also introduced an excise tax on tobacco accessories, such as filters and cigarette papers. From May 1, 2024, nicotine-free vape ingredients will also be subject to excise taxes.

The House of Representatives Committee therefore believes that it is useful to understand the integrity of the tobacco industry chain and the evolution of the tax system through an investigation. In addition, illegal sales and smuggling phenomena need to be evaluated. The report of the Italian Tobacco Federation (Fit) pointed out that the total value of the illegal tobacco market exceeds 1 billion euros, resulting in a loss of about 620 million euros in tax revenue for the country and about 120 million euros for tobacco companies.

All the work of the committee must be completed by December 31, 2024.

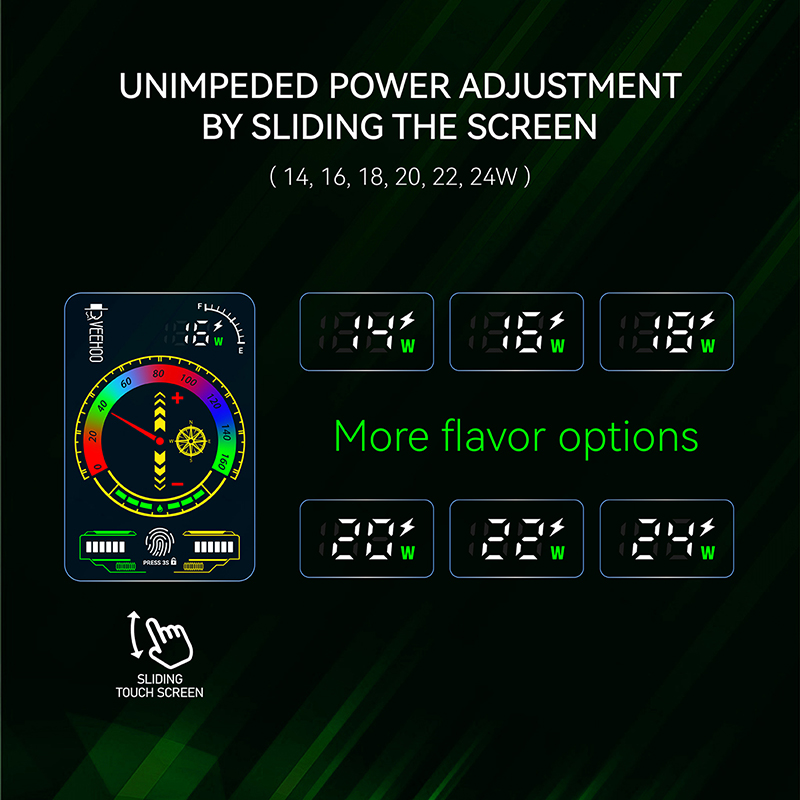

For brands like Veehoo vapes, this investigation and dialogue will be an important opportunity and challenge. Brands need to pay active attention to the formulation of relevant policies, ensure that products meet regulatory requirements, and promote the healthy development of the industry. At the same time, brands should also pay attention to consumer demand and market changes, continue to innovate and provide products that meet health standards to meet the dual challenges of market competition and regulatory requirements.

In this era of change, Veehoo vapes and the entire vape industry will face new opportunities and challenges. By participating in dialogues, complying with regulations, and innovating products, these brands are expected to stand out in future market competition and provide consumers with safer and healthier smoking alternatives.

Tags: Finance Committee of the Italian House of Representatives,Italian vape tax system,veehoo vape